Australia is a leading producer of minerals for the world and produces some 22 minerals in significant amounts from more than 300 operating mines. Minerals are produced in all States and the Northern Territory, except the Australian Capital Territory where there are only quarries used to mine aggregate and other construction materials.

Australia’s largest export is minerals. In 2011, Australia’s energy and mineral commodity export rose to a record A$190 billion, a 15 per cent increase on the previous year signifying continued strong demand for minerals and commodities mainly from China, India, Japan and Korea.

Australia is in the top five mineral producers and has a large inventory of resources of most of the world’s key minerals commodities.

Australia is:

- the world’s leading producer of bauxite, alumina and zircon;

- the second largest producer of gold, iron ore, lead, zinc, lithium and manganese ore;

- the third largest producer of uranium; the fourth largest producer of nickel; and

- the fifth largest producer of aluminum, brown coal, industrial diamond and silver.

Australia also has the largest identified resources of lead, nickel, silver, uranium, zinc and zircon, and the second largest resources of bauxite, copper, gold, iron ore, niobium and tantalum. Australia’s lithium resources are ranked third, and black coal resources ranked fifth in the world.

Having abundant mineral resources, the Australian mining sector offers significant opportunities for investors. If you are interested, please contact us to discuss about these opportunities.

Mining Projects

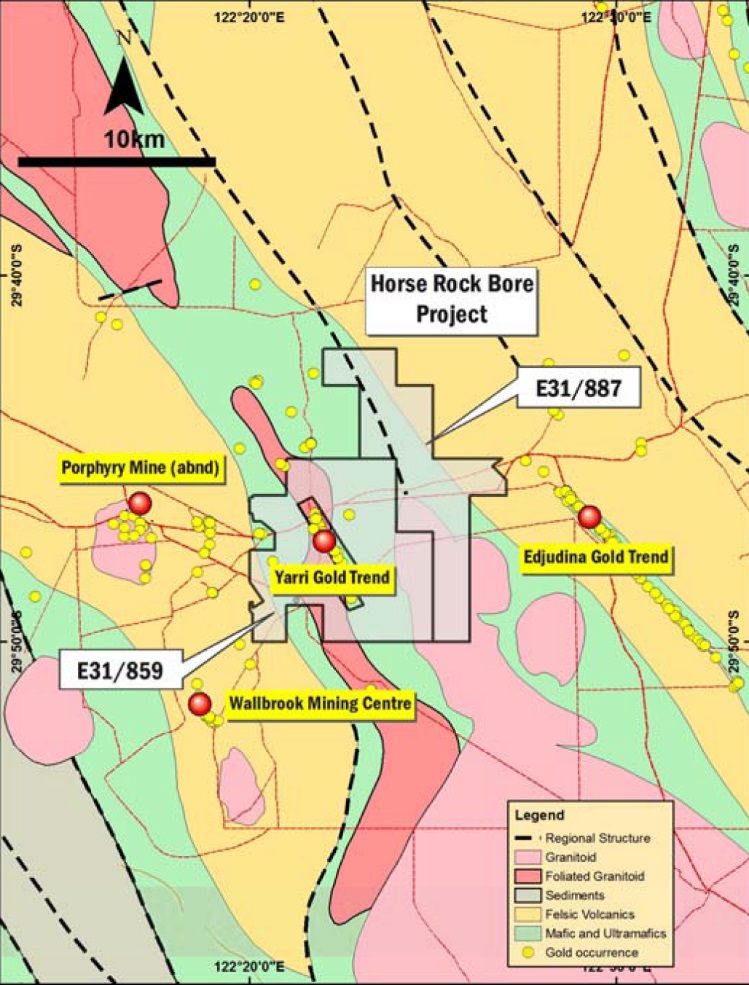

The Company is currently focusing on its Yarri Range Project development, comprising exploration license, E31/1121 which are prospective for gold exploration, located in the Eastern Goldfields of Western Australia, approximately 170 km northeast of Kalgoorlie around the Laverton Tectonic Zone.

The Project area is conveniently accessible via the Yarri/Pinjin Road running through the tenements and connects to the existing haul road network of the Eastern Goldfields and the Goldfields Highway.

The Project is situated in a place historically associated with gold mining activities.Independent studies of regional gold prospectivity have all indicated that the Yarri Range area has high prospectivity for discovering significant mesothermal (Archaean) gold mineralisation. The historical recovery of more than 500 kg of gold from surface workings (0 – 20 m) along the shear zone indicates the possibility for discovery of additional mineralisation at depth. Field and assay data have suggested the likely extension of gold mineralization at depth in the Yarri Range Project area.

Modern and systematic exploration approach will be implemented on the Project with the aim of determining a JORC Code mineral resource from target areas.

Former report

Figure 1 – Project Location

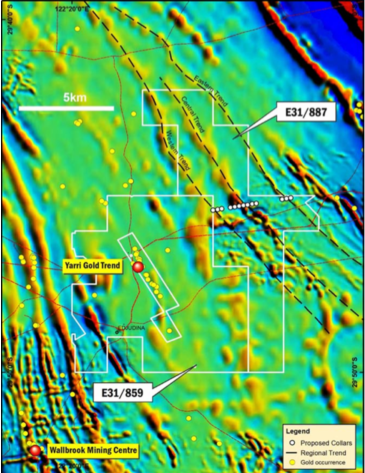

As a first phase of exploration undertaken by GFI a high level targeting exercise identified three distinct magnetic trends that persist through the project. The aircore drilling was designed to provide a first pass test across these targeted trends to test for geological controls and any gold anomalism (Figure 2).

Figure 2 – Program Proposal

RESULTS

Key findings from the drilling include (Figure 3 and Tables 1&2):

Assay results identified hole GAC012 as containing what is considered a strongly anomalous gold response. Assaying returned a result of 6m @ 40ppb Au (60‐66m) including 2m @ 59ppb Au (64‐66m).

The result was an “end of hole” result is interpreted to be part of a classic “interface gold dispersion halo” that can lead to the discovery of more significant oxide and primary gold mineralization.

The mineralisation was associated with a sheared sericitic altered volcaniclastic sediment containing minor quartz veining.

There are currently no constraints along strike to the north or south of this result and adjacent drilling is at least 200 metres away.

Figure 3 – Drilling Results

As previously reported (ASX announcement: June 2016 Monthly Report), a field mapping and sampling trip was completed at the Company’s Horse Rock Project, Western Australia. The aim of the field trip was:

1. Assess the fertility of potential source intrusions which may contain Gold or Base metal mineralisation

2. Sample possible source rocks within the project area

3. Sample Soil near old workings

4. Develop relationships with local pastoralists

5. Create an accurate track log for future work programs

In order to achieve these objectives several days were spent assessing access, meeting with the station owners, assessing the geology in the field and then undertaking a number of soil transects and rock chippings across key geological features and units.

Figure 1 -- Tenement map showing new applications (ELA31/1121 and ELA31/1122)

RESULTS

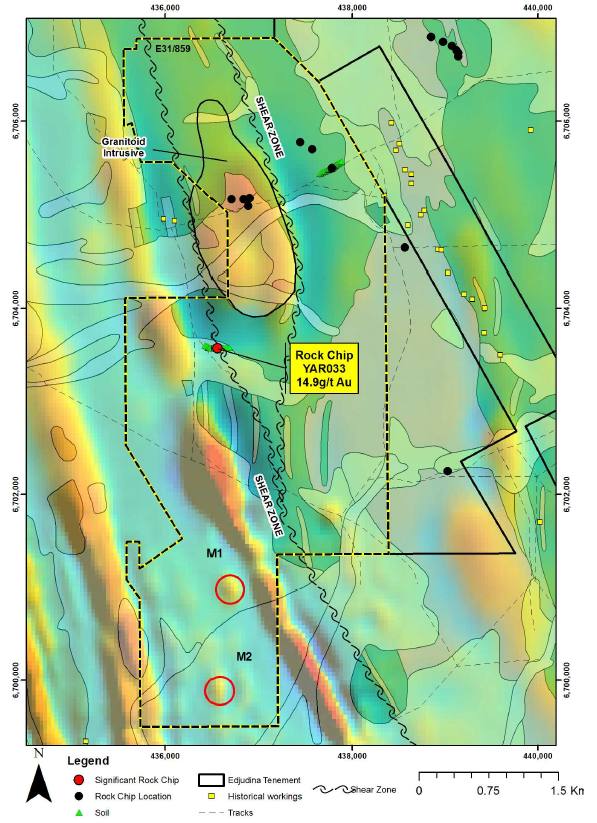

The most significant result was returned from an area of historical mining activity. Rock chip samples were collected and returned a best result of 14.9g/t Au. The importance of this result is the fact that ithighlights a regional shear zone that wraps around a granitoid intrusive. This setting is very similar to that at the nearby Porphyry Gold Deposit.

The shear zone that can also be seen in the airborne magnetic data extends for approximately 10km on the company’s tenements. An assessment of historical exploration data does not demonstrate that drilling has been undertaken at any point along the shear zone.

In addition to the shear zone target a series of “spot” magnetic features have been observed and are considered to be viable exploration targets that require further evaluation.

Figure 2 -- Target Summary Plan

Latest Report

RESULTS:

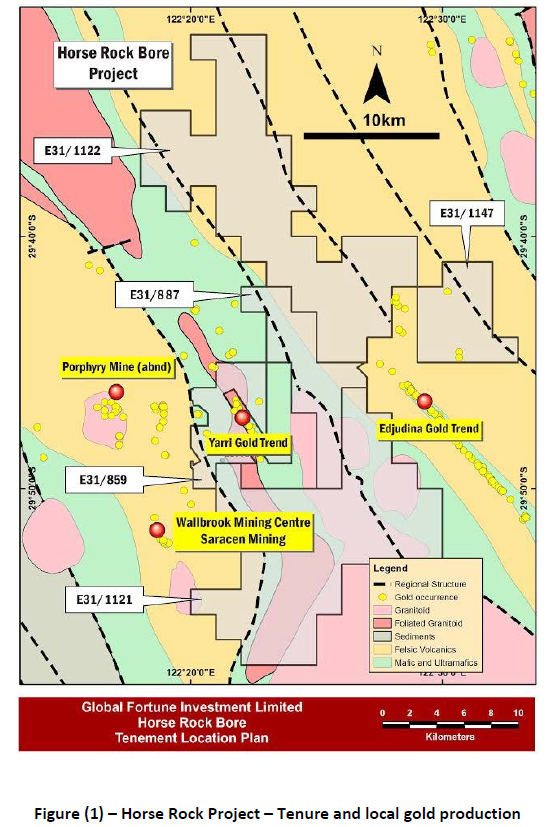

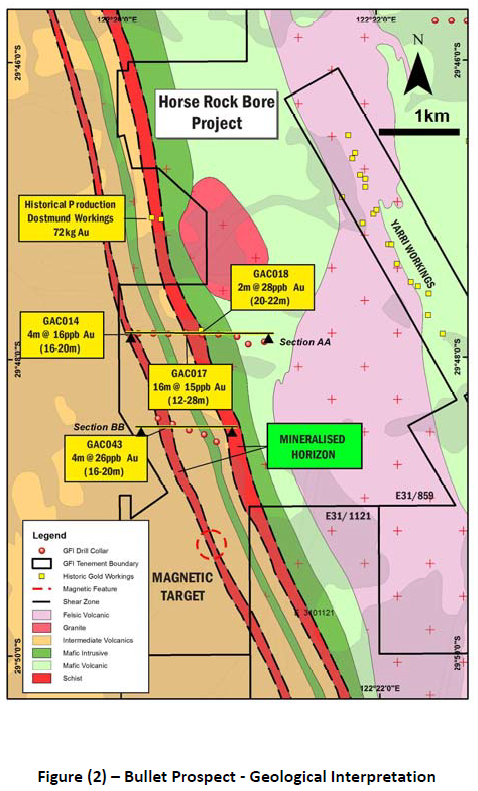

Horse RockProject, Western Australia(100%Owned) - Figure 1

13 aircore holes for 279m across two traverses were completed at the Bullet Prospect located within tenement E31/859. Assay results returned shallow, anomalous results in a series of holes as summarized below:

1. 在E31/887区域内对Bullet及Stark勘探区进行首次地质控制检测及黄金异常测试。

2. 对GFI前期勘探已确定矿化的E31/859区域内的东部剪切带(ESZ)进行加密及延长钻井。

此次钻孔已在12月13日至12月15日期间完成。此次钻井工作由Raglan Drilling Service Pty. Ltd.(卡尔古利)实施,且由勘探咨询公司OMNI GeoX Pty. Ltd.(Fermantle)进行管理。采集的样本已送往Intertek Genalysis Pty. Ltd.(卡尔古利)进行黄金分析检测。

图1 - Horse Rock项目 - 地块占有区及黄金生产

勘探成果:

BulletBullet Prospect - E31/859

13 aircore holes for 279m across two traverses were completed at the Bullet Prospect located within tenement E31/859. Assay results returned shallow, anomalous results in a series of holes as summarized below:

- GAC014 – 4m @ 16ppb Au (16‐20m)

- GAC017 – 16m @ 15ppb Au (12‐28m)

- GAC018 – 2m @ 28ppb Au (20‐22m)

- GAC043 – 4m @ 26ppb Au (16‐20m)

These anomalous results are associated with altered schists and the contacts between different lithologies as shown in Figures 3 & 4. Structurally modified contacts between lithologies are an excellent environment for gold deposition in the goldfields of W.A. Gold endowment has been proven along this trend with previously reported 14.9g/t rock chip and historical Dostmund workings totaling 72kg production.

Although the results are not considered ore grade, they do highlight two distinct mineralized horizons that will provide the focus for additional exploration. Most of these horizons are concealed below recent cover sequences (sheet wash, alluvium and colluvium), this would render traditional surface exploration techniques such as soil sampling and rock chipping ineffective, drilling beneath the cover will be required to further explore this zone.

Two areas have been identified within this trend for further exploration: firstly a magnetic high, highlighted in Figure 2, and secondly; closer to the granitic intrusion where theoretically, increasing structural complexity would be a more favorable environment for significant gold mineralisation – this setting is analogous to the nearby Porphyry Gold Deposit.

Eastern Shear Zone – E31/887

9 aircore holes for 605m were completed across three traverses at the Eastern Linear Trend Prospect within tenement E31/887. Drilling was infilling around the previously identified anomaly (GAC012 – 6m @ 40ppb) and also testing along strike for mineralisation continuity.

Assaying did not return any further significant results meaning. At this point, the primary source of mineralisation has not been identified, RC drilling would be needed to penetrate the fresh rock beneath the previously identified anomaly to identify the source.

StarkProspect – E31/859

10 aircore holes for 294m were completed at the Stark Prospect within tenement E31/859. Drilling was targeting a magnetic feature associated with an interpreted shear zone. Drilling intersected minor alluvial and colluvial cover sequences above a package of predominantly basaltic and mafic intrusive rocks with minor sediments. Very minor alteration and quartz veining was observed. A magnetite enriched mafic intrusive is interpreted as the magnetic feature that was targeted from geophysical imagery.

Assaying did not return any significant results. The regolith profile was noted to be thin, possibly ‘stripped’ and therefore the use of aircore drilling as an exploration technique at this prospect may not be effective as the technique relies upon the dispersion of mineralisation within the regolith to vector towards the primary source. The prospect will be further reviewed before any further exploration.

图2 - Bullet区 - 地质图

NEW PROJECT ASSESSMENT

Given the prospectivity of the Horse Rock Project, the Company is looking to consolidate and expand its holdings in the region. A number of priority areas have been identified that will be reviewed and ranked prior to any open ground pegging or approaches to third parties.

| 矿权编号 | 矿权状态 | 所属公司 | 区块数量 | 面积(平方公里) | 获准日期 | 过期日期 |

| E3100887 | LIVE | GFI | 8 | 23.48 | 2011.2.15 | 2021.2.14 |

| E3100859 | LIVE | GFI | 13 | 32.36 | 2010.7.15 | 2020.7.14 |

| E3101147 | LIVE | GFI | 12 | 35.79 | 2017.9.20 | 2022.9.19 |

| E3101121 | PENDING | GFI | 52 | 154.9 | 待定 | 待定 |

| E3101122 | LIVE | GFI | 52 | 155.2 | 2018.4.1 | 2023.1.3 |

2017年5月最新报告

勘探活动重点

·EL31/859第一阶段目标完成

·岩屑采样计划设定

·区域规模的项目数据汇编及审查

Horse Rock项目 – 西澳

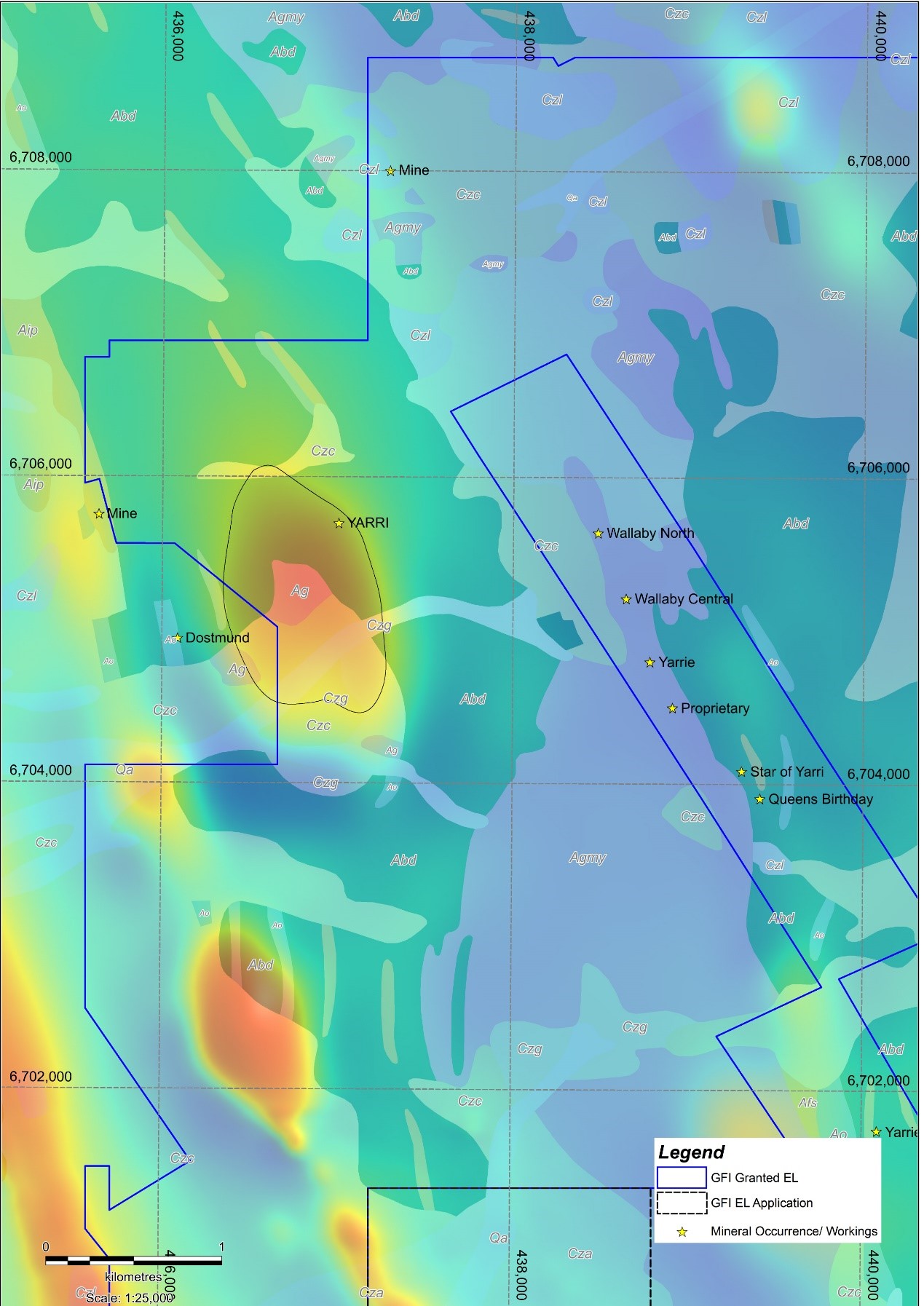

环球财富投资有限公司(GFI)乐于告知,EL31/859第一阶段勘探目标已顺利完成(图1)。该目标为GFI勘探战略的一部分,其目的是开发沿Yarri Gold Trend区域和斑岩矿区的高度异常地区的金属分区和其变更模型。已确认在该区域西部有一个非常显著的磁异常。该目标区域被探测为从花岗岩区展开且已有两个历史性工作的区域(Yarri和Dostmund)(图2)。计划的岩屑采样项目将试图突出重建岩石剖面中的异常,并允许矢量化初级矿化。

续接计划

· 对岩屑侦察的初步项目规划和采样前景预估,收集更改的样品进行光谱反射测量、岩石学和多元素地球化学研究。

· 根据侦察项目的结果,重点绘制地图和变更抽样。

· 根据前期勘探结果进行详细的遥感和地球物理勘测及其相关的变化性研究。

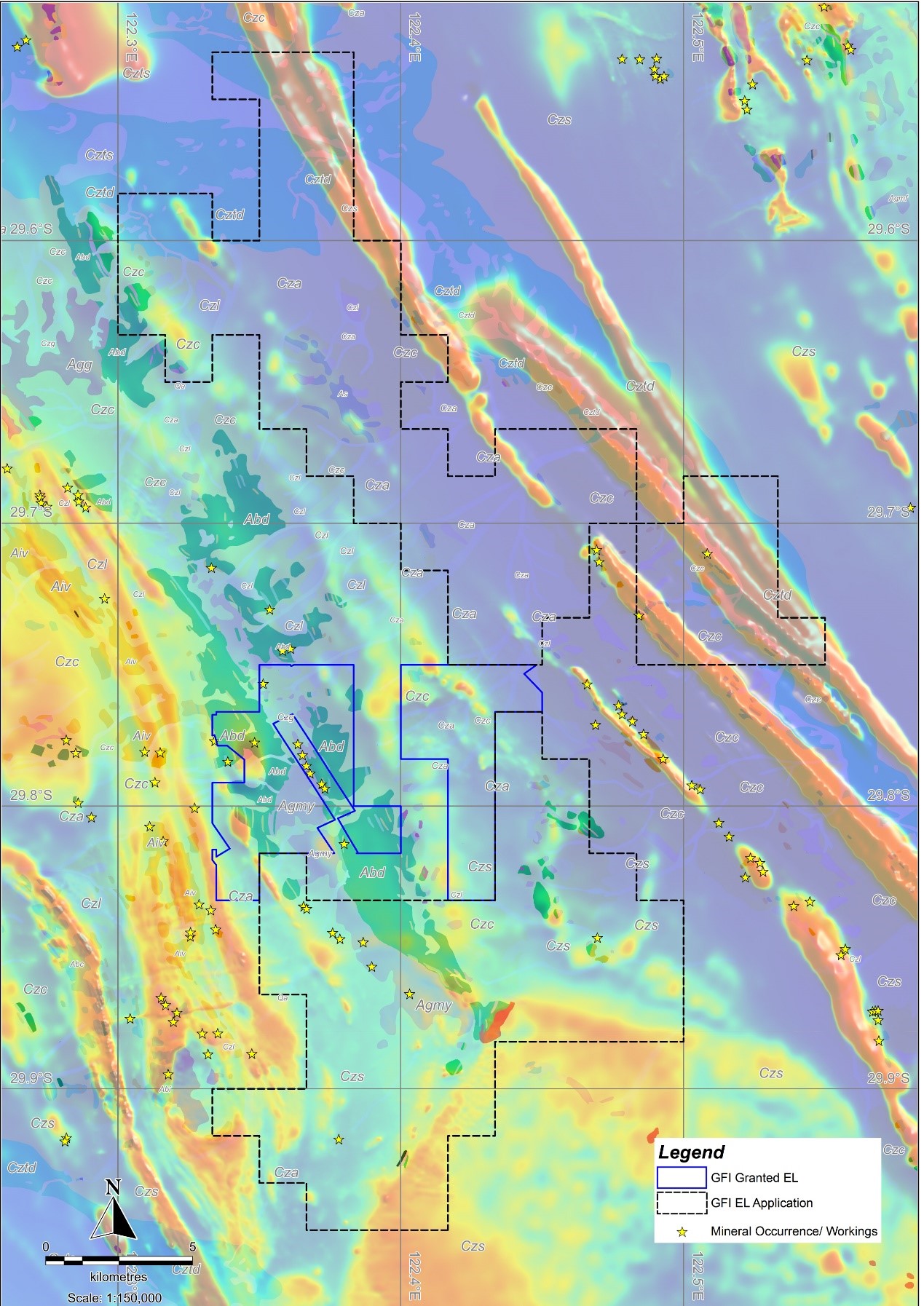

至2017年5月,三项勘探租赁申请进展顺利,预计将在今年下半年实施。GFI将持有400.1平方千米的预期占地。一经批准,该区域将毗邻ASX重要黄金生产商Saracen Gold Ltd和St Barbara Ltd。

图1 – Horse Rock项目 - 1:100k地质学和总磁场强度(TMI)异常区

蓝色线条区为GFI已获批区域

黑色虚线区为GFI申请区域

图2 – Yarri EL31/859 - 1:100k总磁场强度(TMI)Dostmund异常区

蓝色线条区为GFI已获批区域

黑色虚线区为GFI申请区域

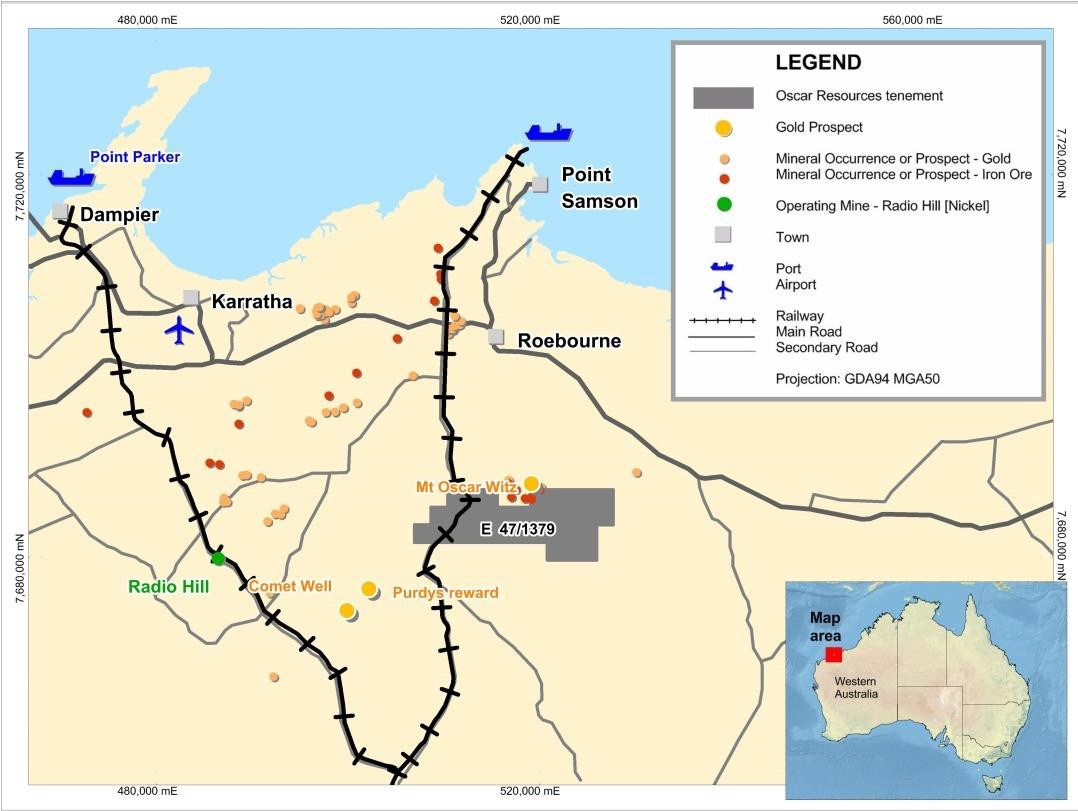

- 位于主要枢纽的大型铁矿石资产

- 具有产出可销售铁精粉产品(>60%Fe)的实际开发潜力的项目

主要特性

- 位于皮尔巴拉的中心地带,离港口约40 公里,有必要的基础设施

- 可持续、独立吨位数:当前勘探目标3.0- 5.0亿吨、含铁31-37%Fe的资源量

- Mt Oscar主矿区3.0-5.0亿吨*

- 比附近其他磁铁矿项目铁矿石的品位高

- 有进行资本配置的机会,即从500万吨/年的铁精矿或高炉烧结矿开始

- 较低的场外服务和物流资本成本优势

- 较低的初始剥离率,如1:1

- 可进一步提高铁精粉的质量生产用于球团矿的铁精粉产品(66%Fe)

- 铁矿资源量上升的勘探潜力巨大

- 有生产800万-1000万吨/年铁精粉的潜力

- 项目地理位置优越,有现有的、正在建设和将要建设的基础设施

- 离海岸和港口约30公里

- 离天然气管道20公里 – 未开发的离岸气田

- 离皮尔巴拉电网15公里

- 离水源10-15公里

- 离高速公路5-15公里

- 离Karratha镇约40公里 – 机场和服务设施

-

- 附近计划开发的天然气、电力等基础设施

- 离亚洲市场5000公里

项目经济性评估*

生产500万吨/年品位66%Fe铁精粉,运行20年的矿山

• 总投资:11.13亿美元(包括磁选厂、工人村、天然气发电厂、矿浆和回水输运管道)

• 运行费用:48.71美元/吨精矿 - 其中采矿21.22美元/吨精粉,破碎和选矿

21.2 美元/吨精矿;

• 生产500万吨精矿/年、精矿产率(重量回收率)30%,磨矿细度25µm占80%;

• 选矿厂含有球磨机、塔式磨矿机和浮选回路以生产出可销售的铁精矿。

财务分析

• 铁矿石的价格:长期125美元/吨和12.5%的价格折扣、100%权益为基础

• 净现值(NPV):8.38亿美元;

• 内部收益率(IRR):22.7%;

• 铁矿石的价格:长期125美元/吨和12.5%的价格折扣、30%权益、8%债务利率

为基础

• 净现值(NPV):10.31亿美元;

• 内部收益率(IRR):47.4%。

*该项工作由澳洲专业公司ProMet Engineers于2012年5月完成的。所有参数取于当时的数据,而澳元兑美元的汇率取为1:1